Hot New

Susan Tompor I Bonds are suddenly hot as inflation heats up What to know

Susan Tompor I Bonds are suddenly hot as inflation heats up What to know

Sure, you can grumble about gas prices soaring well above $3 a gallon at the pump, the sky-high costs for booking a rental car and the price of remodeling a kitchen.

Or you can consider where to make some good money as inflation heats up.

Ever hear of an I Bond? Buying an inflation-indexed U.S. savings bond, called an I Bond, isn’t as thrilling as bragging about buying bitcoin. But you will make a great deal more money now than parking your cash in a traditional savings account.

I Bonds issued from May through October now offer an annualized rate of 3.54%, good for six months, thanks to an uptick in inflation. Remember, though, you are looking at a variable rate that will go up or down over time, and likely change every six months.Pay attention to a variety of rules and restrictions. And if you bought I Bonds say 20 years or so ago, you don’t want to rush to unload the bonds you already have in place. Your old I Bond might be far better than a new one.

I began writing about I Bonds practically since they were launched in September 1998. One column I wrote back in November 1999 carried this enticing headline: “I Bonds rate eye-popping at 7 percent.” The composite rate for the first six months applied to I Bonds bought from November 1999 through April 2000.

I Bonds had some pretty strong sales years in the early 2000s. I Bond sales hit nearly $963 million, for example, in May 2003 and continued to have a strong summer, according to my review of the federal government’s database.

And then nearly $1.28 billion in I Bonds were sold in October 2003.

More than $46.5 billion was outstanding in I Bonds, according to data from the federal government, with nearly 29.8 million I Bonds continuing to earn interest.

Billions of dollars in bonds — and many now say they’ve never heard of them.

No one has been getting excited about savings bonds for many years, especially as we saw interest rates tumble.

As the fear of inflation builds, though, investors are looking for spots where they might profit should prices keep climbing. And I Bonds are gaining more buzz in 2021.

The 3.54% annualized rate applies for the first six months that you own the bond and can fluctuate every six months based on inflation.The rate for an I Bond is two-fold — there’s a 0% fixed rate on I Bonds bought from May through October. And you’re getting an inflation adjustment on top of that fixed rate.

Should inflation continue to heat up, you’ve got a chance to pick up more cash along the way.Should things cool off, there’s a shot that these bonds could be paying 0% at some points down the road. The earnings rate can’t go below zero and the redemption value of your I Bonds can’t decline.

Who’s buying I Bonds?

As much as we’re hearing about a red hot housing market, it turns out that I Bonds are suddenly fairly hot property, too. Far more people are buying I Bonds than just a year ago.

In May, savers bought 26,432 Series I Bonds valued at nearly $127.6 million. That is nearly five times as many bonds bought in May 2020 and almost 10 times the dollars invested at that same time a year ago, according to Fiscal Data numbers reported online by the Bureau of the Fiscal Service, which is part of the U.S. Treasury Department.

In May 2020, savers bought 5,610 in I Bonds valued at nearly $13.4 million.

Those who bought a new I Bond from May 2020 through October 2020 started out receiving 1.06% for the first six months of those bonds. But they are receiving the higher rates now, too, based on inflation adjustments.

Donald Grimes, an economist at the University of Michigan, said he bought some I Bonds this spring as a way to take advantage of the higher rate, seek a hedge against inflation and offer some protection for his retirement savings in a down market. He hadn’t heard of these bonds until a friend mentioned them.

He sees the I Bonds as a much better option for emergency fund money — paying significantly more than money market accounts or savings accounts — as long as you don’t need the money in the first year.”I think stocks are still the best investment over the long run,” he said. “But I Bonds are a better alternative than CDs and any other government bonds today for the ‘fixed’ income part of your portfolio.”

The inflation-based rate on an I Bond reflects the Consumer Price Index for all Urban Consumers. The CPI-U increased from 260.280 in September 2020 to 264.877 in March 2021, a six-month change of 1.77%.Sure, the rates on I Bonds look far better than some savings accounts that pay a piddly 0.01% to 0.03%.

The average rate on a one-year certificate was 0.17% in late June, according to Bankrate.com. The average minimum deposit was $1,427.

One big stumbling block for I Bonds: You’re going to have to wait one year at least to cash out of a new I Bond.

And you’d lose out on the last three months of interest on your I Bonds if you redeem a bond within the first five years of buying it. But the current rate, experts say, may be attractive enough to even lose a bit of interest if you need to sell the bonds in two or three years.

And many see inflation as a growing problem ahead, given pressures in the supply chain, such as those in the auto industry; federal government spending on stimulus programs; pay increases and a push toward a $15 minimum wage.

The earnings rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the 30-year life of the bond, and the semiannual inflation rate. New rates for savings bonds are set each May 1 and Nov. 1.

All I Bonds out there continue to earn interest today. The first I Bond to stop earning interest would be in 2028.How do you buy I Bonds?

Unlike many years ago, you cannot simply walk into a bank and buy savings bonds now.

You can set aside up to $10,000 in I Bonds each calendar year through an electronic TreasuryDirect account. See TreasuryDirect.gov.

It’s also possible to buy up to an additional $5,000 in paper I Bonds if you have a tax refund coming when you file your federal income tax return. You’d need to complete IRS Form 8888 and include it when you file your tax return.

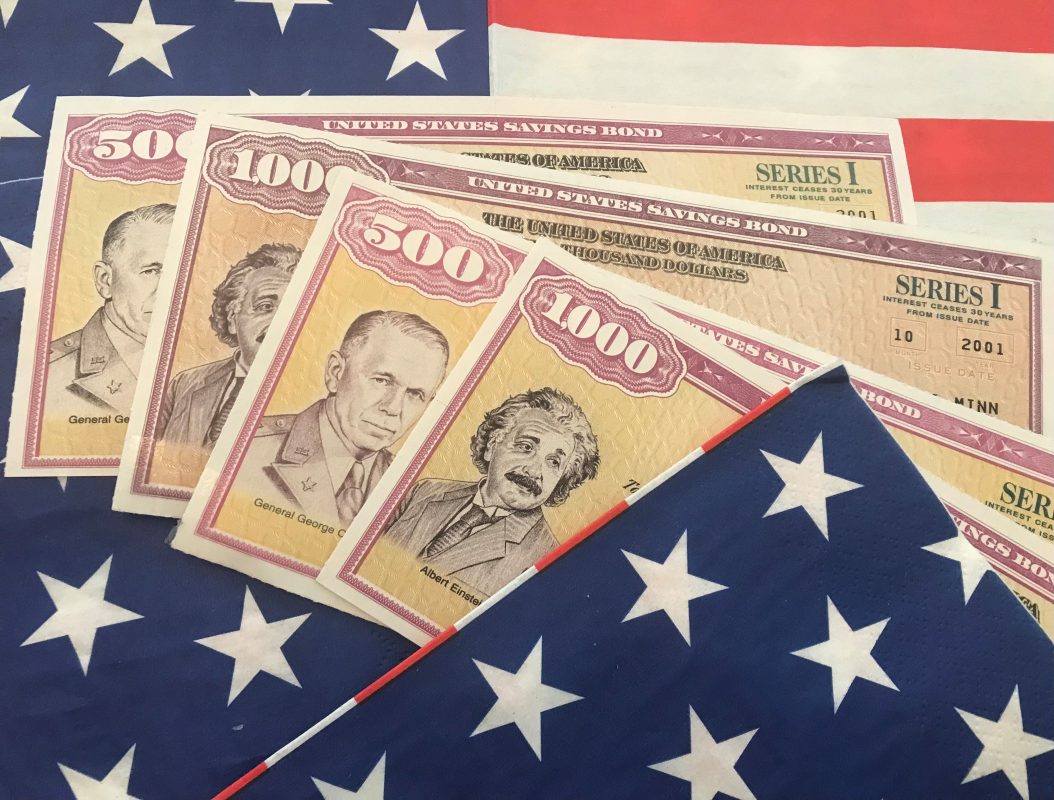

The minimum purchase amount is $25 for an I Bond in an electronic account and the minimum purchase is $50 when buying through a tax refund. (Paper I bonds are issued in denominations of $50, $100, $200, $500, and $1,000, depending on the amount you request.)

Should you buy a savings bond on eBay?

No — not if you’re hoping to cash it.

Anyone buying a savings bond at auction will be unable to redeem that bond and won’t receive any cash.

What you’re getting at auction is just a “piece of paper showing a bond that still is the property of the owner or co-owners named on the bond,” according to a warning from TreasuryDirect.

“In some cases, the bond may be the property of the United States Treasury, if it’s a bond that was lost and has since been replaced. Bottom line: It’s not a good idea to buy a savings bond at an auction because you do not acquire any title to the bond or have any ownership rights.”

What’s a little strange about this I Bond story?

Returning back to my days of covering savings bonds, I tracked down savings bond guru Dan Pederson to help me navigate I Bond sales and trends over the years.

Pederson operates a savings bond consulting firm out of Monroe and has a website called BondHelper.com. Pederson still puts together savings bond statements for a fee to spell out the value of one’s savings bond holdings, as well as rating the best savings bonds to keep. He is reachable at bondinformer@gmail.com.

Pederson and I have talked over the years about all sorts of oddities in the savings bond program and trends. He pointed out something strange about the latest data.

What’s interesting, he said, is that savers are redeeming their old I Bonds at a fast clip now, too.Savers actually cashed out more savings bonds than they bought in May.

According to the Fiscal Data numbers, savers redeemed 90,260 Series I Bonds in May 2021 — cashing out nearly $167.8 million.

From January through April, savers redeemed more than $701 million in I Bonds this year.

There could be a long list of reasons why some people want their money now.

Some might have bought those bonds 20 years ago and figure it’s OK to live a little now. Or they’re trying to help their children get through college.

Some could need the money now to pay bills after retiring earlier than expected or losing a job.

Some families may have faced the death of a loved one and decided to cash the bonds.

But Pederson is concerned that there could be another reason: Some people clearly do not understand the I Bonds that they have or how these bonds work.

It’s possible, he said, that some people may be reading about new rates on I Bonds and think that their old I Bonds are stuck earning far less than a new bond pays. But that’s not true at all.

Right now, any I Bond bought before May 2021 is not a worse deal — and many could be a far better deal — than a new I Bond bought from May through October.

Take I Bonds issued from November 1999 through April 2000. The floor is a fixed rate of 3.4% on those bonds and that floor is usually maintained for the 30-year life of the bond. (Pederson notes that the only exception is deflation. “If we have a negative 1% inflation, it could provide a short term where the rate is less than 3.4% but above 0% on the combination of the two,” he said.)

So the higher inflation premium of 3.54% offered now is added on top of 3.4% — driving it up to 6.94% for a six month period — if you bought an I Bond during that period some 21 years ago.We’d be back into those “eye-popping I Bond rate” days.

The fixed rates are all over the map on I Bonds — ranging from 0% now to 3.6% offered on I Bonds issued from May 2000 through Octob

er 2000. The TreasuryDirect.gov site has a chart that details the 30-year fixed rate for I Bonds issued since September 1998 through the current I Bonds. The site also has inflation rates and composite rates.

Pederson said the last thing someone would want to do is sell off an old I Bond in the hopes of getting a better rate by purchasing a new I Bond issued from May through October.

If you do that, you risk selling off a bond that’s paying a higher rate than you’d get now.

Yep, there’s a lot more to I Bonds than meets the eye.